A business plan is an essential tool for any entrepreneur, serving as a roadmap for your business goals and how you plan to achieve them. A good business plan provides a clear vision, focuses on actionable steps, and increases your chances of success. It can also help you secure financing and leases for equipment or space, and gives employees and investors confidence in your idea. Your plan can be updated as your business grows and changes.

What is a Business Plan?

A business plan is a roadmap of your business goals and how you plan to achieve them. It answers the questions of who, what, where, when, why, and how.

A business plan lays out what your business is and how it works, but it also looks at your goals and how you plan to achieve them. You can think of a business plan like a roadmap showing where you’re starting, where you want to go, and how you want to get there.

A business plan will answer all the questions you can think of regarding your business.

- Who is involved, who are your customers and competitors?

- What are you selling, what makes your business unique?

- Where are you located, where are you marketing to your customers?

- When will you breakeven, when you will have a grand opening?

- Why did you start this business, why did you set your prices that way?

- How will you run your business, how much will it cost, and on and on?

This is important for you as the business owner, any partners or employees, and any investors, lenders, etc. that will be getting involved in your business to understand it with confidence.

Create a Strong Business Plan

A strong business plan:

- Tests the viability of your idea

- Provides clear vision and focus with actionable steps and timeline

- Increases the chances of business success

- Demonstrates your commitment to your idea

- Gives employees and investors’ confidence in your idea

- Helps you obtain financing and acquire leases for equipment or space

- Is a living document that is adjusted as your business grows and changes

Parts of a Business Plan

The Executive Summary is always first in the business plan, but it’s written last. That is because the Executive Summary is an overview of the whole business plan. Someone should be able to read the summary and get all of the most important information from the rest of your plan.

Next is the Company Profile. This is where you introduce yourself, and your team or partners if you have any. You would also introduce your company, what you do, why, and what your value proposition is.

After introducing your business comes Market Research. This is where you document your research results – who are your target customers, where are they, what do they want, who are your competitors, how do you compare. Include your research data, statistics, and analyses like SWOT (this stands for Strengths, Weaknesses, Opportunities, and Threats).

Next is Sales & Marketing. Outline your Marketing Strategy and current plan and your Pricing Strategy for your product or service. Of course, you should also justify these strategies using the Research you just presented in the previous section. Your strategies should always be based on research.

Operations describes the day- to – day activities other than Sales & Marketing. Obviously, marketing and providing services or making sales is a huge part of any business, but there is all of the behind the scenes work such as paperwork, hiring, producing, training, etc. How will your business run? Who is doing which tasks, when are you doing them, do you need any particular tools or software or outside support?

Answer all those questions here.

We will be talking specifically about Financials in the second half of this debrief, but for now, we’ll say that the Financials come toward the end of the Business Plan. This is where you’ll put the financial information like start-up costs, how much you expect to lose and gain in 1-2 years, and some other information. All of these numbers should be based on research and data.

What Financial Information is Important?

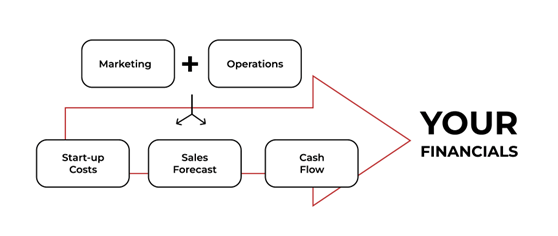

Prepare your financial information last as it draws on key elements of your marketing and operations plans. If the end goal of your business plan is to obtain financing, keep this in mind before you start.

As previously mentioned, the last 2 sections of the business plan to write are the Executive Summary and the Financial plan. The Executive Summary captures information from all parts of your business plan, so that is truly the last part to write, but for the financial plan you have to know your plans for Marketing and Operations.

These 2 parts of your plan will have the greatest impact on your financial planning. It’s also important to mention that if your goal is to get loans, grants, investment, or any financing, you need to think about that as you are writing your business plan, especially the financial plan. Always keep your audience in mind!

For your Financials need to consider 3 parts: Start-up Costs, Sales Forecast, and Cash Flow. Let’s look at these 3 parts one -by- one.

Start-up Costs

First, Start-up Costs. Your start-up costs include anything that you need to start your business. This means equipment, office or retail space, setting up a website, all of your legal aspects like registrations, permits, certifications, any loans you need, tools, software–anything that’s important to starting your business. This does include past purchases so if you need a printer, but already have one, put it on the list!

Sales Forecast

Next is the Sales Forecast. You might have noticed in the Financials section that this is where your Marketing and Operations plans are important. Your Sales Forecast takes information from your Marketing plan for the costs of your Marketing and the estimated return on those investments.

You also need to know your Operating Costs. This includes salaries and all the payroll costs associated, any recurring costs like license renewal, rents, or website hosting fees, etc. This is also a Forecast, so you’re making some predictions about the next 1-2 years of your business and how much you’ll be making in Sales. You have to have realistic numbers with justifications for them, which means looking at the economy, your industry, demand and competition, and your pricing strategy.

Cash Flow

The last part of the Financials is your Cash Flow. Cash Flow looks at the monies coming into your business and where they go. So, if you receive a loan, how much was it and how was it used. You make some money in sales, how much and how it was used. Consider all your Revenue Streams and Assets. If your business owns any equipment or property, including IP include that. Additionally, include your Expenses – all payroll, including yourself, fees and rental costs, business upgrades, new Market Research or Product Development, etc.

Your goal for Cash Flow is to be close to zero – although for most businesses it’s very common to be in the negatives or “The Red” in the beginning of starting your business. Also, very important to your Cash Flow is to not forget taxes.

If your business is collecting Sales Taxes from customers, you need to hold onto that for the government and remit it at tax time. You must keep track of that money because it will sit in your business but does not belong to the business.

Cash Flow is something you’ll be doing consistently in your business operations, so it’s important to have a good system. There are lots of tools and apps to help with this and you can do a bit of experimenting to find the one that works best for you, just be careful to keep your records accurate and up to date.

Parts of a Business Plan

Additional Information

- Information to add more to your business plan

- Examples of additional information

- Pictures, research graphs, diagrams, charity partnerships, timelines, etc.

The 6 components we just talked about are the standard parts of a business plan, but there may be more you would like to add – either at the end or throughout your plan.

Some examples could be pictures (especially if you have a product or location) research graphs or charts, diagrams (especially if you don’t have a product or location yet), introducing a charity partnership or cause that your company is actively supporting as part of your bigger mission (something that is pretty common here and could be part of your marketing strategy as well), timelines for sales goals or expansion goals, or whatever vision you have for how your business will grow and how you expect to make that happen.

There are other things you could add, it really depends on you, your business, your industry, and so on, but be aware of not adding too much. The 6 parts were just discussed are the focus and you don’t want key information getting lost.

Create a Strong Business Plan

Take your time. Depending on your business idea, it can take weeks or months to create a professional and thorough plan.

- Hard work

- Time

- Energy

- Commitment

Now you know the parts of the business plan and why you need one, but there are still some more things you’ll need to create a strong business plan. You will also need to put in hard work, time, energy, and commitment. A business plan is a big project – you should take your time and do it properly. Depending on your experience and idea, it can take weeks or months, maybe a year even, to create a professional and thorough plan.

Again, there are a lot of benefits to having a well-made business plan – having research to inform your business practices, having a plan written down for your everyday work and for the future, helping to get investors and/ or partners, and so on.