Starting a business is an exciting journey filled with opportunity, innovation, and growth. But before you launch your product or service into the world, it’s essential to understand the legal and structural foundations that will support your success. This guide is designed to help aspiring entrepreneurs and small business owners in Canada navigate the key considerations when starting a business, from choosing the right business structure to understanding legal responsibilities and protecting your interests.

While this guide provides valuable information, it is not a substitute for professional legal or financial advice. Be sure to consult with a lawyer and an accountant to make informed decisions tailored to your unique business goals.

Business Structures in Canada

There are three main structures:

- Sole Proprietorship

- Partnership

- Corporation

*Consult a lawyer and accountant before choosing a business structure.

Sole Proprietorship

What is it?

In a sole proprietorship, you are the sole owner. This is the most common structure for small and medium sized businesses.

- All profits (after taxes) are yours to keep

- You are fully responsible for all debts and obligations

- Creditors can make a claim against your business and personal assets

Advantages

- Simple to start

- Less administrative requirement

- Only one tax return for business and personal

- Lower taxes for net income amounts less than $90K

Disdvantages

- Unlimited liability

- Possibly higher taxes for net income over $90K

- No separation between you and your business

- May restrict access to government and other types of funding

When to use it?

Many businesses start as sole proprietorships and incorporate if and when it becomes appropriate.

- Tend to be more service-based businesses where the service provider is a self-employed professional, such as: lawyer, dentist, consultant, tattoo artist, life coach, etc.

- Liability insurance can protect you from service-related lawsuits

Partnership

What is it?

A partnership is a non-incorporated business created by two or more people.

- Partners share in the profit

- Each partner is jointly liable for the debts of the business

- In a limited partnership, a person can contribute to the business without being part of operations (silent partner)

Advantages

- Easy and inexpensive to set up

- Partners’ resources are combined

- Motivational and emotional support

- If income from the partnership is low or is losing money, it can be written off on the personal tax return

Disdvantages

- Unlimited liability

- No legal separation between you and your business

- Can be difficult to find a suitable partner(s)

- Potential conflict with partner(s)

- Financially responsible for business decisions made by partner(s)

When to use it?

Partnerships are similar to sole proprietorship.

- Limited liability partnership is normally used for a group of professionals, such as: lawyers, accountants, etc.

- A legal professional should create a partnership agreement that includes: percentage of ownership, division of profit and loss, length of partnership, decision making and dispute resolution mechanisms, and process for withdrawal or death of a partner.

- Liability insurance can protect you from service-related lawsuits.

Corporation

What is it?

An incorporated business issues shares to owners proportional to the percentage of ownership.

- May be one owner / shareholder or many

- Any size or type of business can be incorporated

- Most common structure for large businesses

- Is a legal entity separate from its shareholders

- Incorporation can be federal or provincial / territorial

Advantages

- Separate entity not related to an entrepreneur

- Flexible structure

- Ability to divide the ownership (shares)

- Potentially reduced taxes for net income above $90K

- Ability to divide types of income and plan for personal income tax

- Shareholder protection from creditors and certain liabilities

Disdvantages

- Closely regulated – paperwork and filing requirements

- Expensive to set up

- Extensive corporate records are required, including documented minutes filed annually

- Potential for conflict between shareholders and directors

- May be required to prove residency or citizenship of directors

When to use it?

Think about incorporating if your business:

- Creates liabilities

- Has employees

- Expects to generate income over $90K in the near future

Naming Your Business

Sole Proprietorship/Partnership

Register your business name under the Business Names Act (Ontario) to receive a Master Business Licence. If the business is being carried out under the owner ’s / s’ personal name, it is not necessary to register. If it is under a different name, you must register.

Corporation

You must file articles of incorporation, provincially or federally, and then register your name. A NUANS search is required to prove that the name is not already being used.

A NUANS search compares proposed corporate names, business names and trademarks, with existing names and trademarks in a national database. It provides a list of the names found to be similar.

Legal Processes

Registration

- Sole Proprietorship/Partnership – Master Business Licence and business name

- Corporation – federal or provincial registration and a NUANS search

Certifications

- Licencing

- Permits

- Professional memberships

Operations

- Municipal regulations regarding: registrations, bylaws, insurance coverage, permits

Trademark

- Unique combination of words or designs

- Protects a service or product name (prevents others from profiting from your business’ reputation)

- Separate fees for filing, registration, and renewal

Harmonized Sales Tax (HST)

- Register when revenue exceeds $30K in a 12-month period

- File annually or quarterly using the ‘standard’ or ‘quick’ method

- Different criteria depending on the territory/province

Protecting Business Interests

It is important for you to review and understand your legal liabilities and responsibilities.

As a sole proprietor/partner:

- Protect yourself

- Research and obtain the appropriate liability insurance

As an incorporated business:

- Protect yourself

- Protect the corporation

- Record internal policies, procedures, processes, and decision

- Understand compliance requirements

- Avoid personal guarantees or collateral for loans

Corporate Roles

An incorporated business does not have unlimited liability.

As an entrepreneur, you may have liabilities depending on your role within the organization. Generally, there are three corporate roles entrepreneurs will take on. When you perform multiple roles, there is potential for conflict.

Shareholder

- Ownership, appointment of directors, share in proceeds of a sale of corporation

Director

- Strategic development, critical decision making

Officer

- Day-to-day operations

Hiring

People are an important part of your organization’s core strength. Requiring staff can happen quickly. For example, you may need a full- time receptionist, or someone to help you temporarily to handle workload during a busy season.

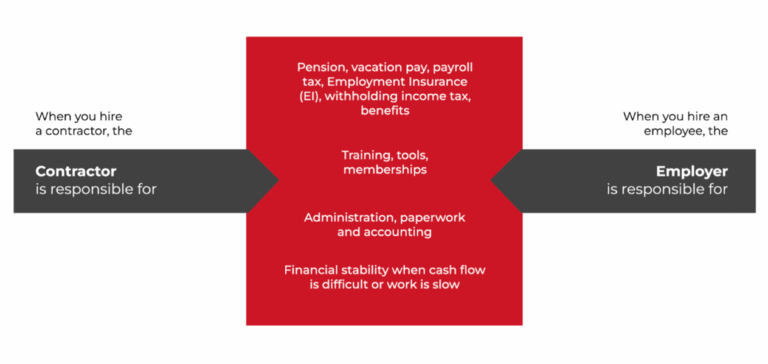

Should you hire contractors or employees? There are benefits and drawbacks to both and financial consequences of getting it wrong.

Contractors vs. employees

There will be a difference in cost and flexibility depending on whether you hire a contractor or an employee.

Protecting yourself

Here are some steps you can take to ensure you do not mis-classify a worker:

- Review and comply with the CRA criteria for classifying worker

- Consult with WSIB and CRA to get a determination before hiring

- Consult with a lawyer before hiring

- Ensure working relationship reflects the written agreement